Cryptocurrencies are a type of digital money created from code. The most popular cryptocurrency is Bitcoin which was introduced by Satoshi Nakamoto a group of programmers in 2009.

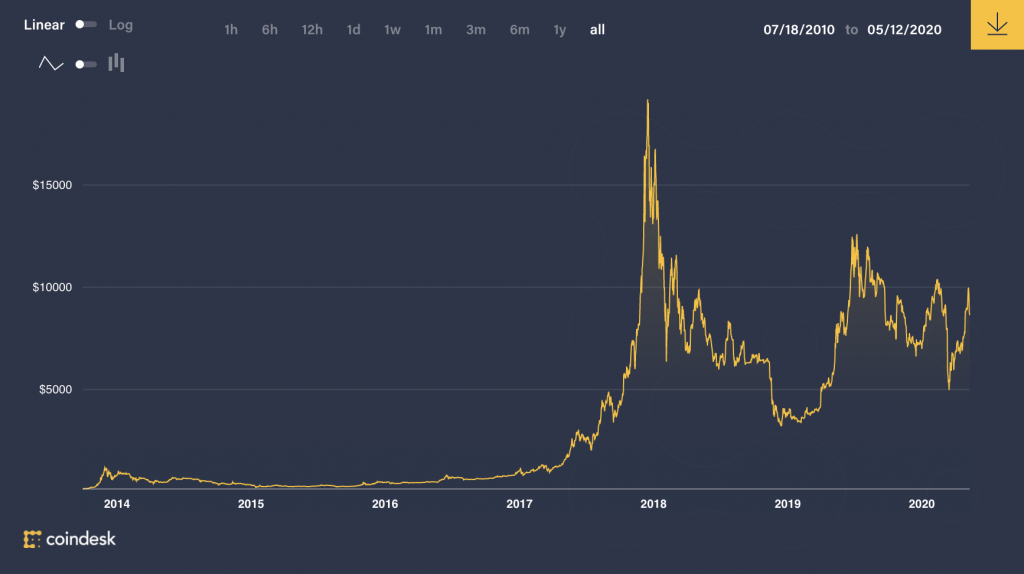

Bitcoin like all investments has the potential to go up and down. Given the nature of this kind of investment, you’ll find that it’s incredibly volatile and can swing up to 80% in either direction in just a couple of days – as demonstrated during the worldwide financial crisis of 2020.

When Bitcoin launched in 2009 they were practically free at around $0.003 each. One year later, one Bitcoin was valued at $0.39, and by the end of 2017, that same Bitcoin was worth over $1,900.

It’s unknown exactly how many people bought Bitcoin in these early stages and held them until the peak in 2017. However, we do know that today there are currently 17,971 Bitcoin millionaires. This is calculated upon the number of people with more than $1 million in their Bitcoin wallets.

How Rich Did Bitcoin Make Investors In 2017

In December 2017, Bitcoin hit an all-time high of $19,343. Had someone purchased one Bitcoin for $0.003 when they were released in 2009 they would have made $19,343 profit.

Had someone purchased one Bitcoin in 2015 for its yearly average of $253 they would have been gained a profit of $19,090. Finally, had someone purchased one Bitcoin at the beginning of 2017 for around $893 they would have made a profit of $18,450 in less than 12 months.

However, this period of strength for Bitcoin didn’t last long which only further highlights how volatile the market is.

On the 1st December, one Bitcoin was worth $10,859, one week later it had almost doubled to $16,858. It maintained this level of pricing until the 18th of December at which point it’s value began to drop. By the end of the month, Bitcoin had dropped almost 15% to $13,860.

Bitcoin Vs Dow Jones

Bitcoin seems exciting to many given this high volatility. In December Bitcoin made the jump from $10,859 to $16,858 before going back down to $13,860.

However, the Dow Jones, a stock market index which measures the performance of the largest 30 companies listed on stock exchanges in the United States adjusted only slightly from $24,305.40 on December 1st to $24,849.63 on December 29th.

That’s a change of a little over 2% across the month compared to Bitcoins swings of up to 60% in the same period.

People Who Made Millions From Bitcoin

There are some people who have made millions and in some cases even billions of dollars from Bitcoin and other cryptocurrencies. However, most of those who have been sourced are those who own companies relating to trading the currency.

Micree Zhan Ketuan is estimated to be worth almost $3 billion as the co-founder of cryptocurrency mining giant Bitmain. The company is the largest supplier of Bitcoin mining equipment and operates two of the largest bitcoin mining pools, BTC.com and Antpool.

Brian Armstrong is the co-founder of one of the best-known cryptocurrency exchanges in the US, Coinbase. Having raised $300 million from fundraising the value of the company reached an estimated $8 billion giving Mr. Amstrong an estimated net worth of $1.25 billion.

Finally, and perhaps most famously is one of the most talked-about Bitcoin millionaires, Erik Finman. Mr. Finman invested $1,000 his Grandma left him in Bitcoin at age 12 after a tip from his older brother, six years later he became a Bitcoin millionaire.

Mr. Finman is now age 20 and has a net worth of approximately $4 million. He has continued his research into cryptocurrencies and is currently working on a number of projects.

Bitcoin Volatility Makes For A Dangerous Investment

The lack of historical data and demonstrated volatility in the market demonstrates how dangerous of an investment Bitcoin can be when compared to more traditional investment stocks and funds.

It’s worth remembering that just like any other investment Bitcoin could crash to zero. While some companies did begin accepting online transaction payments in Bitcoin, interest has died down significantly due to the ever-increasing market volatility. You can find companies that currently accept Bitcoin as a form of payment here.

Transactions and interest of the currency are one of the key factors in its ability to thrive or fail. All this makes for researching and following the currency incredibly important compared to the intermittent research and checks you may do when purchasing and holding traditional stocks and index funds.

Ultimately, Bitcoin is not a get rich quick scheme. It happened before, and it very well could happen again but it’s an incredibly risky gamble. All investments should be made as part of a diverse investment portfolio and you should contact a licensed financial advisor (I am not a licensed financial advisor) about suitable investments based on your individual circumstances.