To many, it may seem bizarre that you could have $2,000,000 and still go broke. However, it’s certainly possible, especially if you’re planning to give up your job and live solely off your net worth.

You can easily live off 2 million dollars and not go broke provided that the money is invested strategically and spent responsibly.

In this article, we’ll discuss what I believe to be the best ways to live off $2 million and not go broke.

Dividends

In my previous retirement articles, I’ve discussed the strategy behind investing your pension and savings wisely and living off the interest/dividends and a portion of the worth over a period of time.

The same principle applies today.

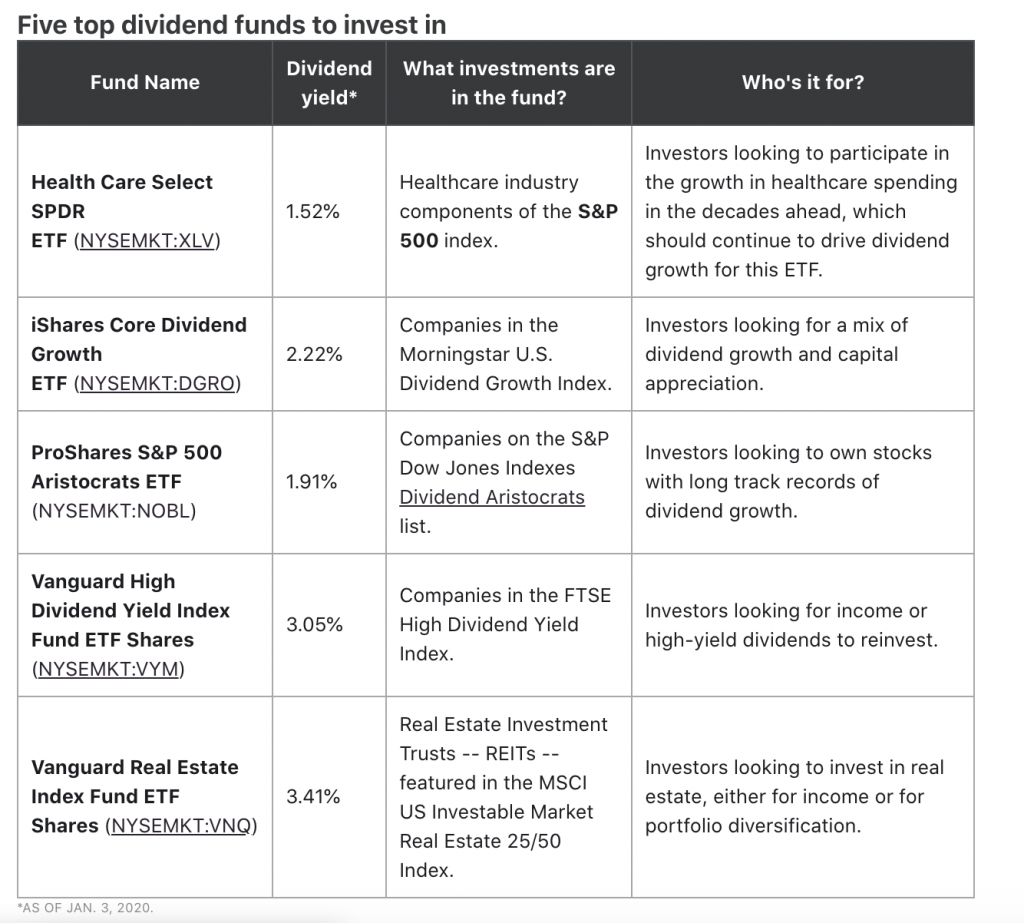

As of writing the top five dividend funds currently have an average yield of 2.42% – I took the average to try and give some balance to the market.

Assuming you invested the full $2 million (which isn’t advisable, you should always look to diversify your investments) you would earn $48,400 per year from dividend revenue.

That’s more than $4,000 a month, and just 20% less than the average US salary at the time of writing.

Certificate Of Deposit

Another great option for your money and one which is financially backed by the FDIC is certificates of deposit.

Each CD is backed by the FDIC for $250,000 so with $2 million you would need to open at least 8 accounts if you’re going to be fully protected.

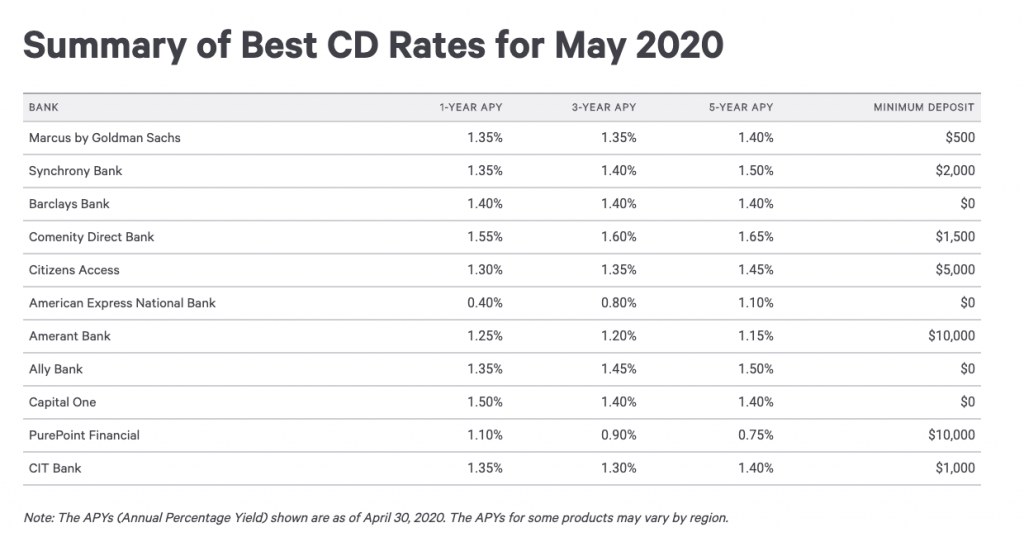

As you’re likely to need the income each year we’ll base the income on the average 1-Year APY interest which is 1.26%

Unsurprisingly given the lower risk involved the revenue generated each year from $2 million is just $25,200.

This equates to $2,100 per month. An amount I believe you could easily live on provided your home is also paid for.

You’ll find that you can also get a similar rate of 1.26% from the majority of good savings accounts if you’re looking to divide your assets across multiple different safe locations.

Real Estate

Real estate has its risks and often requires a more hands-on approach than the other more traditional investments. However, the long term rates could be fantastic from a $2 million investment.

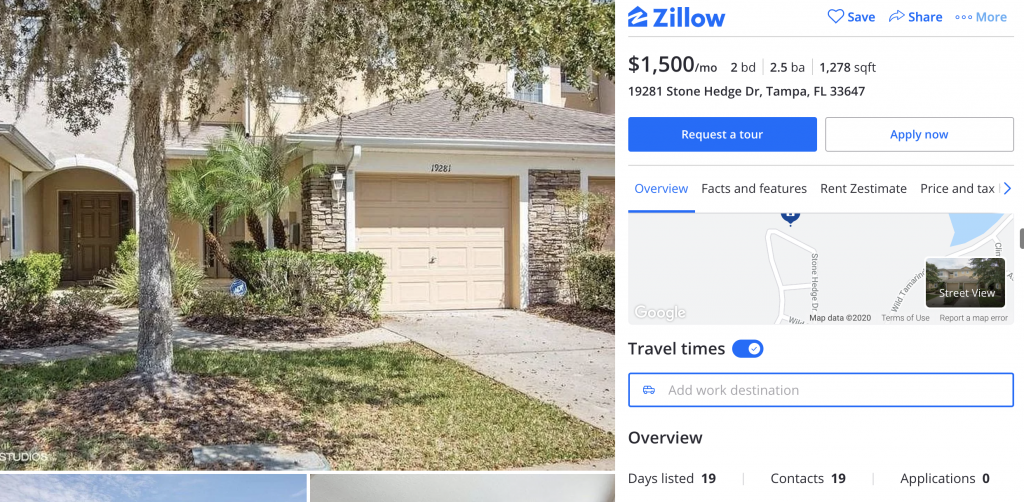

Let’s assume aim to buy some properties in the Tampa Bay, Florida area. Right now a relatively modern 2 bed, 3 bath townhouse retails for around $156,000.

With $2 million you could buy almost 13 of these, but for arguments sake we’ll round it down to 12.

A similar house on the same estate is currently on Zillow to rent for $1,500 a month.

Again, for argument’s sake lets assume we agree on a rental of $1,300 a month for each of these properties.

12 properties at $1,300 a month is $15,600 or $187,200 a year.

Again, none of this accounts for property taxes, repairs, and the time in which the property is empty.

However, in total it’s likely to be significantly more than other investments. Of course, the number of properties you can buy, taxes, and rental returns are going to vary depending on the city and state you live in but it’s certainly something to consider

With those types of returns, I estimate you could even pay a property rental manager a fee to look after the property for you and still get a better return on investment than CDs and dividends from index funds in the majority of areas.

I found the majority of rental managers will offer a discount on multiple properties and charge a percentage on rent collected (rather than rent agreed so you’re only paying them if the tenant pays the rent).

The average percentage in these cases is between 6% and 10%. Assuming we take an average of 8% on the 12 properties at $1,300 a month is $15,600 or $187,200 a year.

You would pay $1,248 a month in fees. That still leaves you with $14,352 a month.

On top of this let’s assume each property is only rented out for 10 months out of the 12 months of a year to allow for tenancy changes and failures to pay rent. This takes the income down to $11,960 a month.

Finally, let’s assume you take 15% of the rent and put it into savings to repair the property as needed. From a $1,300 rental return that’s a further $195 a month or $2,340 in total for the 12 properties.

That still leaves you with an incredible $9,620 a month or $115,440 a year return or 5.75%.

Reit

If you fancy all of the wealth that property may bring without the hassle you could also look at investment opportunities in REITs.

REITs are known as Real Estate Investment Trust and are companies that own, operate, or finance properties which in turn produce income.

90% of the taxable income from these properties which could be made up of commercial or residential are then distributed between the shareholders on a regular basis (that would be you).

REIT accounts can be opened with as little as $500 and you can easily spread your money between different REIT companies and different REIT investments to further diversify your portfolio.

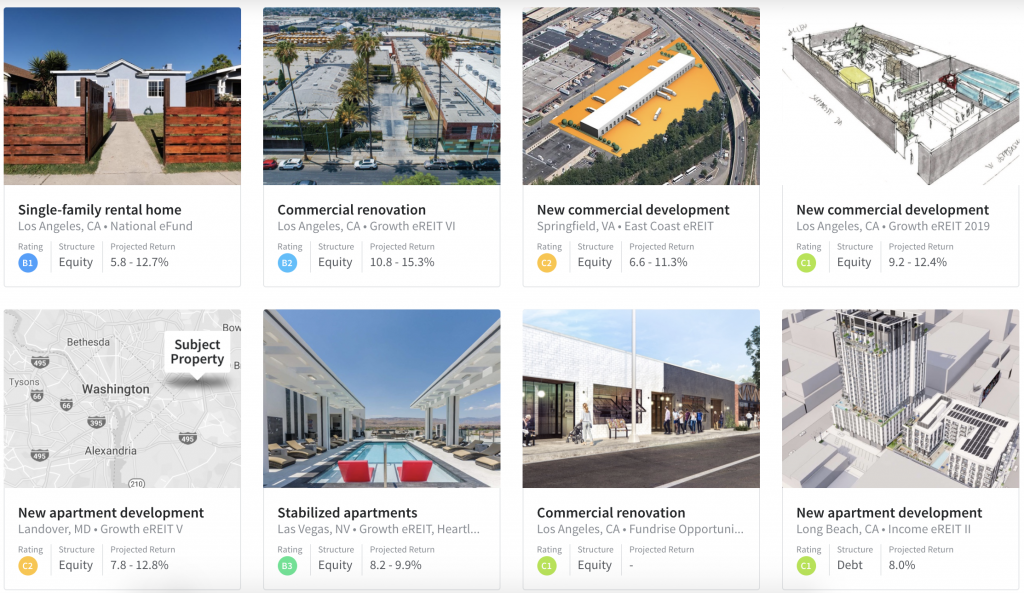

One of the largest companies offering REITs is Fundrise.

On the Fundrise website, you can see past investments. These investments are given a rating depending on their risk. A1 is the best rating, and often provides a lower projected return but is a much safer investment.

C3 for example is a much lower rating, these often provide higher returns but come with significantly higher risk.

Depending on the portfolio structure you aim for past results have seen investors get between 8.7% and 12.4% annual returns before fees (which are currently set at just 1%)

The portfolios available are currently; supplemental income, balanced investing, and long-term growth.

Assuming you invested the full $2 million with Fundrise and got the lowest return of just 8.7% annually.

You’d see a return of $174,000.00 a year, pay $20,000 in fees giving you a net of $154,000.

Conclusion

Not all of these investments are going to be suitable for everyone. However, they certainly should provide you with food for thought when it comes to the potential that $2 million invested wisely brings.

My final thought is this. Assume you create an equally split portfolio;

$500,000 in index funds providing dividends – Returning $12,100 annually.

$500,000 in certificates of deposit – Returning $6,300 annually.

$500,000 in real estate – Returning $28,860 annually.

$500,000 in REITS – Returning $38,500 annually

You would see a total annual return of $85,760 which is more than 50% higher than the current average annual income and therefore more than enough money to live on.

I’d love to know your thoughts and opinions in regards to the different ways to invest money down in the comments below.

As always I am not a financial advisor. These are purely my opinions based on research. Any financial decisions should be discussed with your personal, licensed financial advisor. I am not responsible for any losses you make as a result of this article.

what about real estate taxes??? Wouldn’t that be $5,000 or so per unit per year?