When you start thinking about retirement one of the first things that comes to mind is the sum required. From experience, I’m pretty sure one of the top Google searches about retirement has to be “What’s the best amount to retire on which doesn’t see you working for longer than you have to or want to”.

It’s definitely possible to retire on $800,000, however, your quality of life during retirement is likely to depend on the age in which you choose to retire and your withdrawal rate.

Depending on your age where that $800,000 lies is likely to be somewhere between taxable accounts (savings, stocks, bonds, etc) and retirement accounts (pension, 401k etc.).

Let’s assume you have an even split between the two – While it’s unlikely it makes the maths and following this process much easier.

So that’s $400,000 in a pension, 401k, etc. and $400,000 in some savings, stocks, bonds, index funds etc.

Provided you’re under the pension age you’ll probably begin a withdrawal from the savings, stocks, and bonds fund first and leave your pension to continue compounding and gaining interest.

At this point, we’ll assume two things;

You are retiring at aged 40.

You need $2,000 to live on a month or $24,000 a year.

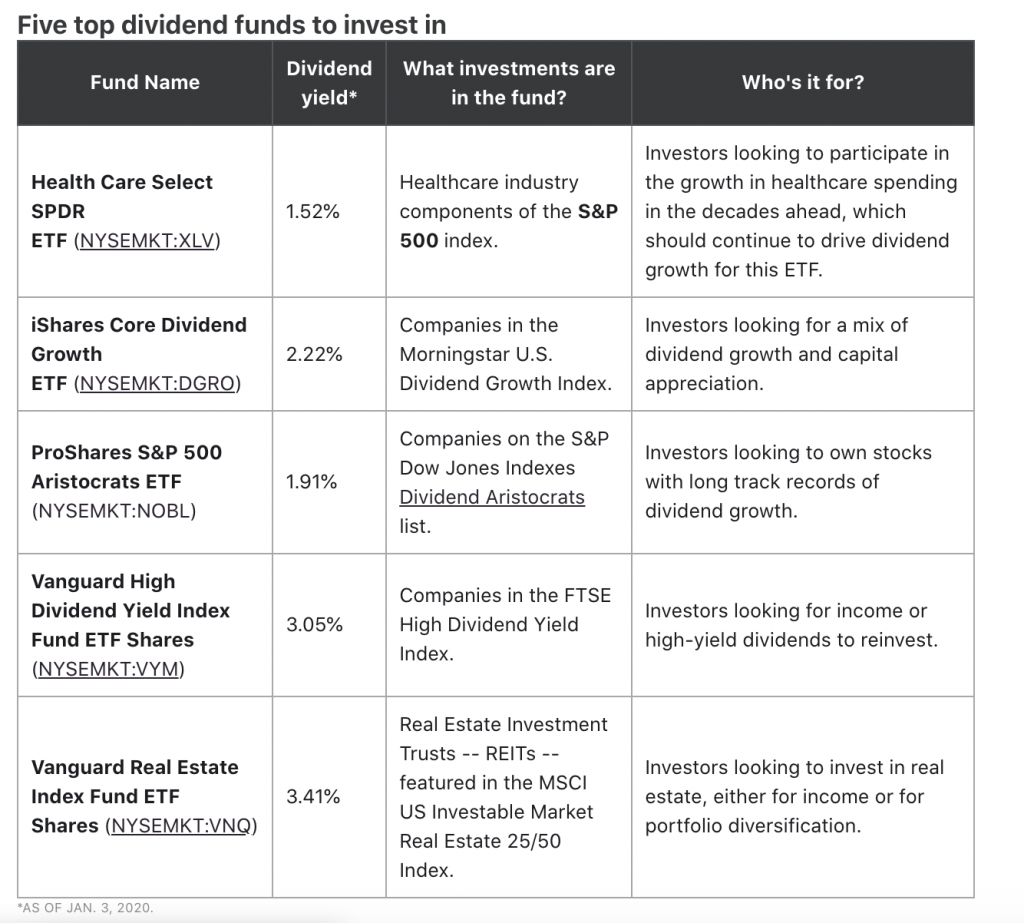

As of writing the top five dividend funds currently have an average yield of 2.42% – I took the average to try and give some balance to the market.

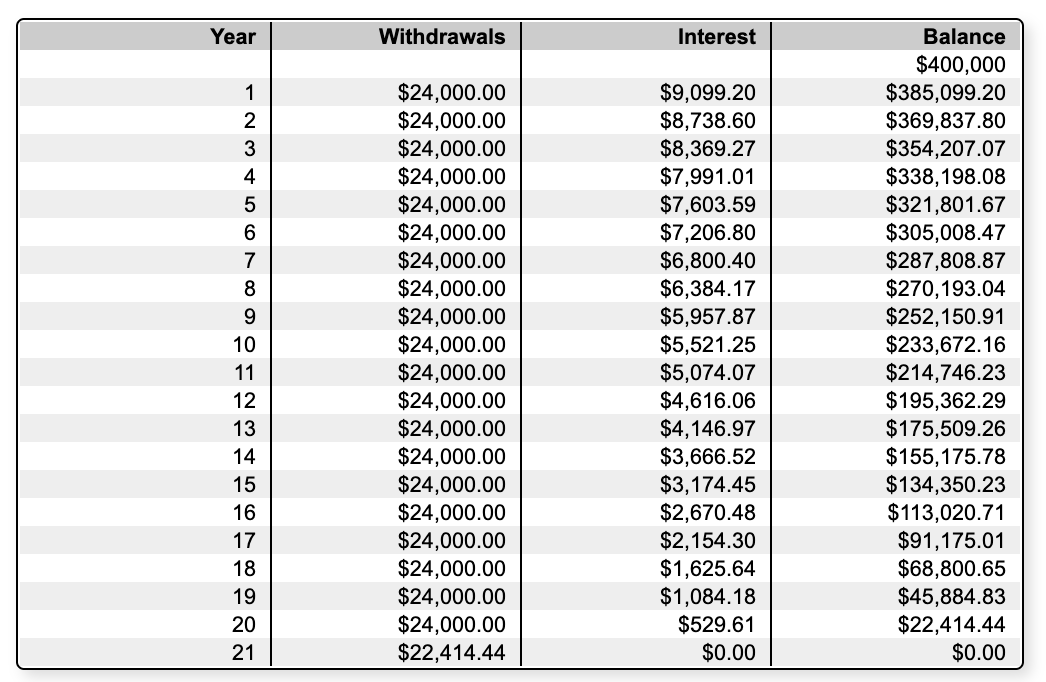

With these kinds of returns, it would be 21 years before you run out of cash (based on the $400,000 investment).

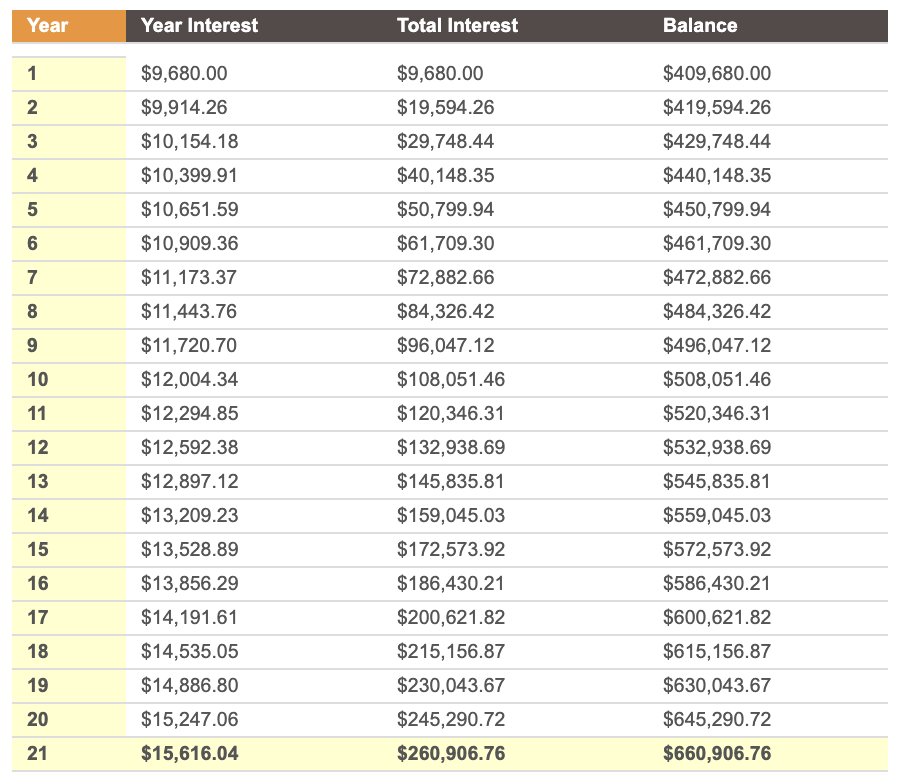

At this point, you would be 61 and eligible for penalty-free withdrawals from your pension. However, it’s 21 years later and the $400,000 you had in that pension account has now grown from $400,000 to $660,906.76 (again I’ve based this on an annual compound interest rate of 2.42%)

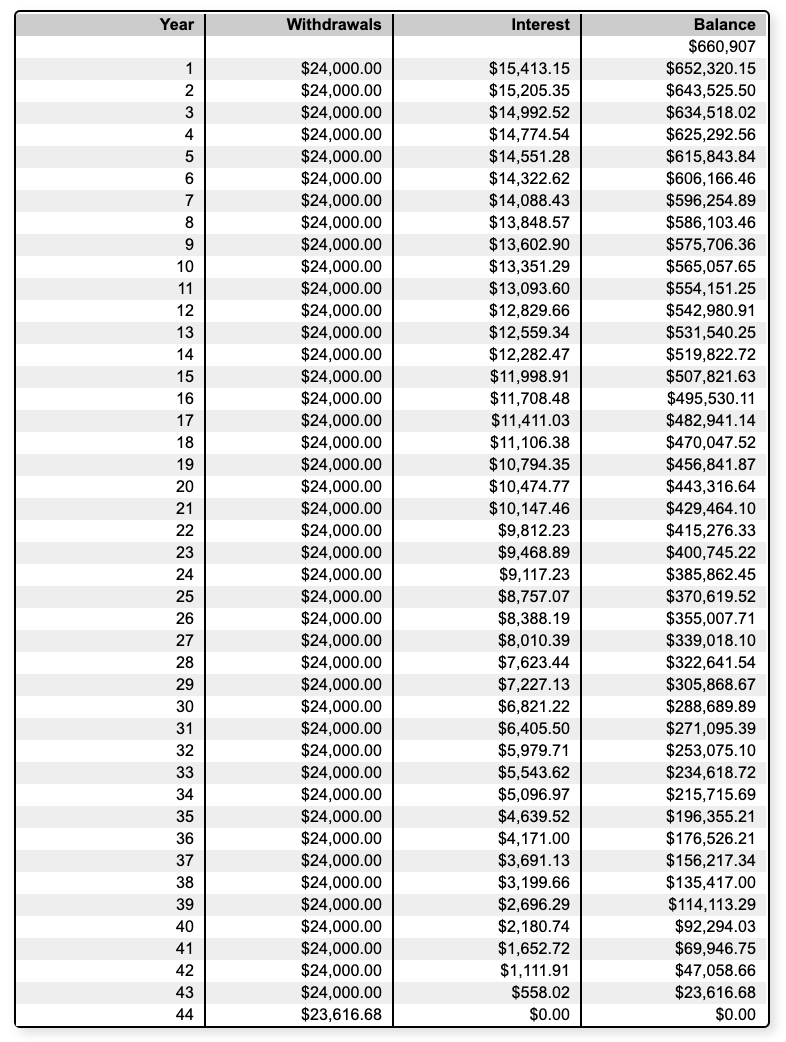

Based on a withdrawal of $24,000 annually once again and a continued interest rate of 2.42% it would be almost 44 years before your money runs out.

By which point you’d be 105, congrats!

There’s no doubt there’s a number of variables to consider in this process. Such as health insurance, mortgage, rent, or home living costs, interest rates, inheritance, etc. However, it’s certainly food to thought as to how retiring early on a relatively small fixed amount is easily possible.

I think $800,000 at around age 40 is very much a tipping point number. Based on the 2.34% interest rates it’s incredibly close to the 401k penalty withdraw charges and is based on current numbers (I expect the age will have increased over the course of the 21 years in which you’re actually retired) so I’d probably either save a little extra, retire a little later, or spend a little less in those early years.

Then, of course, it’s based on living costs of $24,000 a year which to someone currently earning and spending $50,000 is going to seem simply insane. Again, it’s likely to depend on your current circumstances and financial responsibilities, but it is definitely possible.